The Gorilla Trades Stock Investing System

Click here to take the GorillaTrades Quiz.

Manage your stock portfolio according to risk, return potential, and market sector. Gorilla Trades takes the guess work out of how and when to buy and trade stocks. This Gorilla Trades stock picking system tutorial explains what is involved in picking the best stocks, what systems are in place, and how they help you make good decisions in the buying and selling of stocks. You can print this tutorial if you prefer, and soon be on your way to investing in the stock market; buying and selling stocks and building your portfolio.

The GorillaTrades System

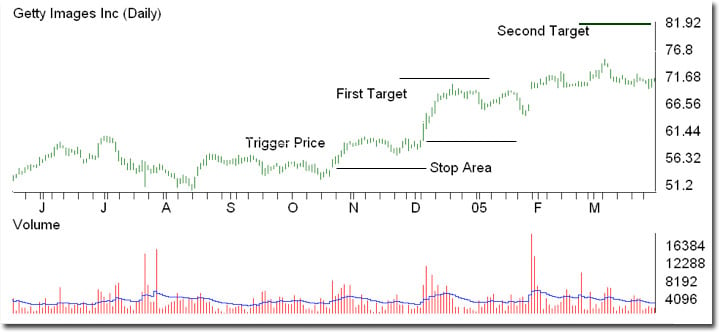

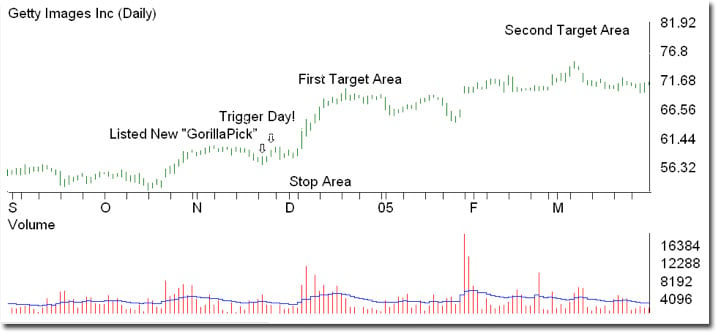

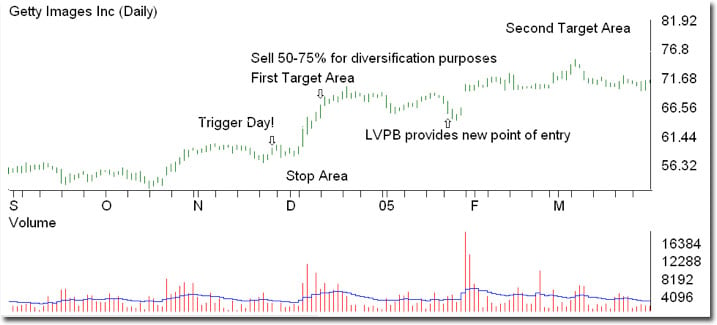

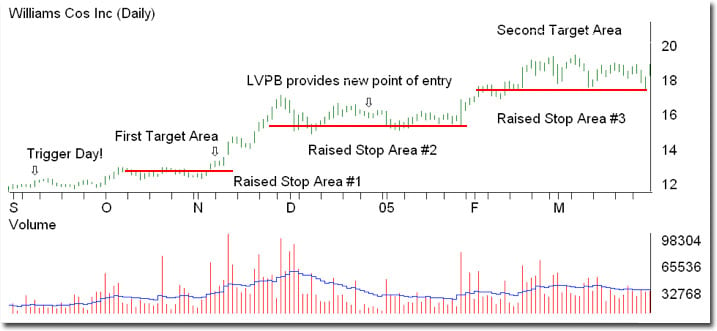

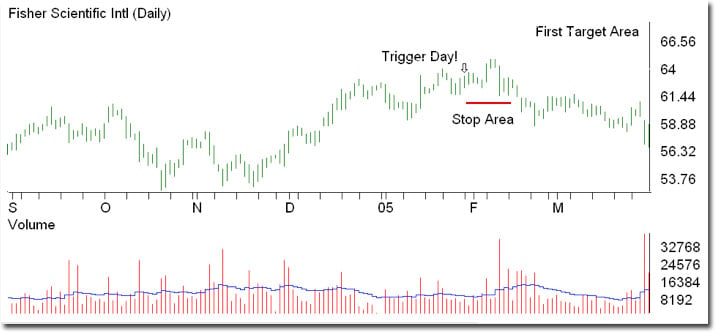

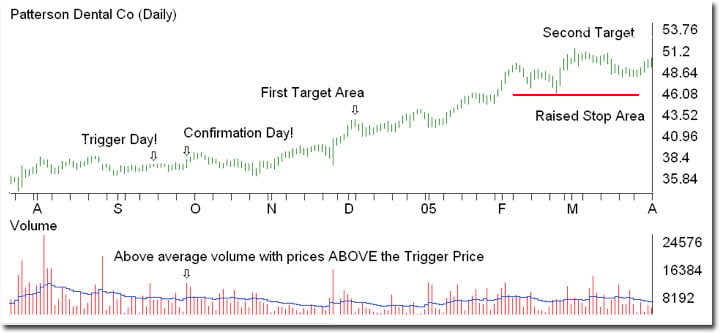

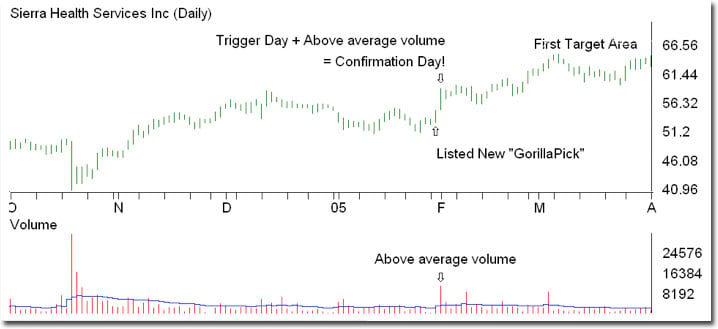

The GorillaTrades radar sifts through over 6000 stocks each night looking for only those stocks that meet each and every one of the 14 different technical parameters that the Gorilla has found to be present in most stocks before they make explosive upward moves. Included with each GorillaPick, is a stop loss level, a first target, and a second target, which work together to eliminate the guess work and the time-consuming effort involved in successful stock investing. The first target may take a few days or a few weeks to be achieved. Subscribers are advised to sell 50%-75% of their position at this target, depending on the overall market environment (mainly for diversification purposes). The second target may take a few weeks or a few months to be achieved. On average, only the absolute best one or two stocks that the Gorilla finds are listed for potential purchase each evening, however, not all of these will actually enter the portfolio.

Trigger Price

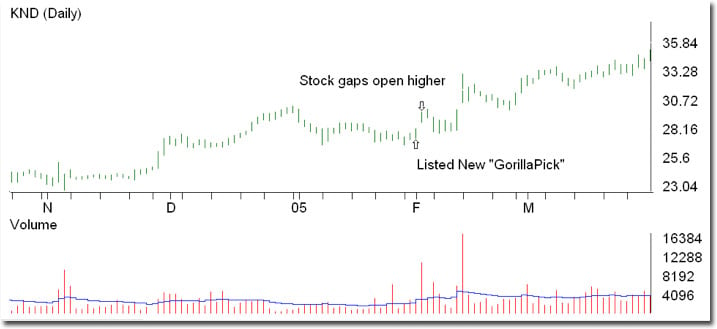

The reason new GorillaPicks are only “potentially” for purchase is that a new GorillaPick must trigger in order to be considered for purchase. To trigger, a stock must trade above the HIGH of the day, on the day before its initial listing in the nightly email. Note that this is its day’s high, not the closing price. Sometimes new GorillaPicks take a bit longer than one day to trigger. In fact, as long as a new GorillaPick trades above its Trigger Price within FIVE sessions of its initial listing, it is considered to have “triggered.” However, if a new GorillaPick does NOT “Trigger” within five sessions, it expires and will NOT be considered for purchase.

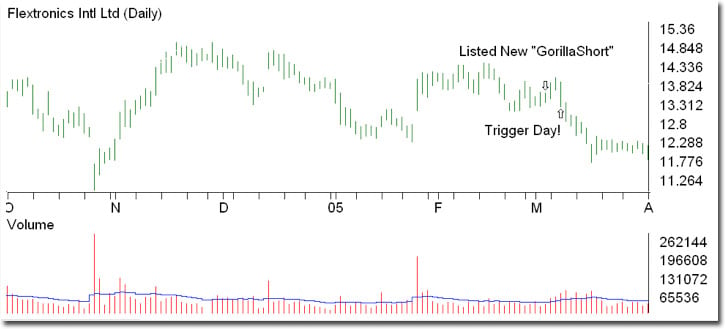

GorillaShorts and Trigger Price

For GorillaShorts, the exact opposite “Trigger Price” rule applies, simply substitute “low price” for “high price.” A GorillaShort has five sessions to trade lower than the low of the session prior to which it was first listed, in order to be considered as “triggered.” All new triggered GorillaPicks and GorillaShorts are reported in the Gorilla’s Evening Email.

Trigger Price (cont.)

If a GorillaPick gaps higher, through its “Trigger Price” on an opening print, this opening price is then considered the trigger price of record for the new stock in the GorillaTrades portfolio. Please note that under no conditions should a potential GorillaPick be considered for purchase if it gaps up more than 5% above its trigger price! While this type of upward gap is normally a sure sign of strength, the upside potential simply becomes much less attractive.

Once triggered, some subscribers make their initial purchase. However, other subscribers wait for a Confirmation Day to increase their probability of success with the trade. (The Confirmation Day concept will be explained later in this tutorial.)

First Target

As the size of the GorillaTrades’ portfolio increases, the Gorilla understands that not every new stock idea can be purchased. Introducing the theory of the First Target; an innate way the system can be diversified.

As GorillaPicks achieve their first target, a portion of the position is suggested for sale. Subscribers are made aware of this percentage, which varies on overall market conditions. The Gorilla advises subscribers to sell 50%-75% of their position at the first target, while the remaining portion is left to grow towards the second target. If the amount of capital available to you is limited, you may decide to sell 75% at the first target. However, if capital is not an issue, you may decide to only sell 50% at the first target.

The remaining portion is left to grow, possibly to the stars! The excess capital (which is always a profit) is used to purchase new GorillaPicks or to add to some of the strongest, proven, top-performing positions. Over a period of time (usually 3-4 months), your portfolio will have weeded out the weakest GorillaPicks and retained the strongest.

GorillaPicks that experience pullbacks may NOW have more room to advance (refer to the LVPBs and RTR tools for our advised strategies). The First Target strategy not only diversifies your portfolio and captures profits, but also helps to avoid steep declines that can steal hard earned, UNREALIZED gains.

Second Target

When seeking second targets, understand that GorillaPicks rarely achieve these targets because their stop levels are reviewed, and raised weekly, as GorillaPicks display greater strength than the overall stock market. When a GorillaPick does achieve its second target, it is usually because it has gapped through the target, on an opening print. Since stocks have unlimited upside potential, GorillaPicks will remain in the portfolio until they show any significant weakness, or reverse their upward trend.

The GorillaTrades system seeks solid entry points with the potential for large projected returns. Example: GorillaPick SKX maintained a strong uptrend for almost seven months, generating a 108% profit! When damaging weakness occurs, the Gorilla is always prepared with a raised stop loss level to save his subscriber’s unrealized gains. Once again, keep in mind that GorillaPicks remain active in the portfolio until either their second target is achieved or they stop out.

Stop Loss

The use of Stop Loss Orders has proven to be even more important than upside targets over the past several years. In fact, it is THE MOST IMPORTANT FACTOR (BY FAR) FOR TOTAL RETURN! While taking losses is inevitable in investing, the important thing is to avoid BIG losses. Stop loss levels are routinely managed and raised, as GorillaPicks appreciate in price. GorillaPicks that have confirmed will generally have much tighter stop levels than GorillaPicks that have simply triggered. Raised stop loss levels are communicated to subscribers weekly, via the Trader’s Notes section in each of the Gorilla’s Monday evening email.

With the use of stop loss orders, there is absolutely no reason why any subscriber has to “watch” the market during the trading day. That is precisely why GorillaTrades is here! The process is fully mechanical. GorillaTrades takes the emotion out of investing; the number one reason for investor failure! Note: Always use the Gorilla’s figures as guidelines, and realize gains and losses according to your personal risk parameters. Furthermore, the Gorilla recommends researching the type of stop order that is appropriate for your specific style of trading.

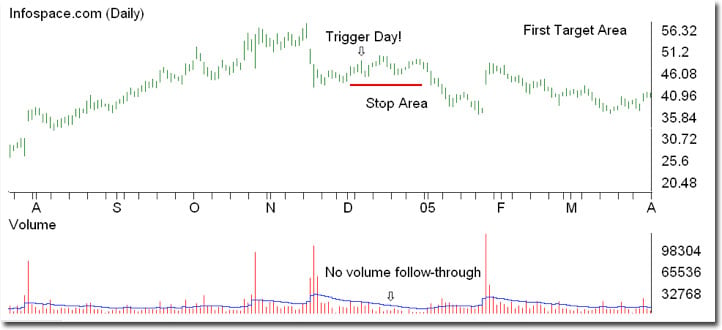

Confirmation Day

After a GorillaPick has triggered, many subscribers watch for a Confirmation Day prior to purchase. The Confirmation Day is a concept that was developed to help subscribers avoid “false” stock moves that trigger a GorillaPick on only the illusion of strength. GorillaTrades always reports every stock that Triggers, as more aggressive subscribers might purchase at the trigger price. However, most of our less aggressive subscribers will wait for a Confirmation Day to purchase. Almost every GorillaPick that does NOT confirm turns out to be a loser, so subscribers’ actual results are ultimately even better than the GorillaTrades’ overall performance.

It should be noted that during strong periods in the market, you can enter orders without waiting for a Confirmation Day because a very large percentage of GorillaPicks do go on to confirm. However, during weak periods, in which an unusually low percentage of GorillaPicks have Confirmation Days, waiting for a Confirmation Day is paramount. It could very well make as much as a 10%-15% difference in your overall return!

Confirmation Day (cont.)

Waiting for a Confirmation Day has proven to increase the probability of success in a trade, while helping to preserve capital during negative market environments. By waiting for the appropriate volume to fortify a GorillaPick’s desired direction, subscribers reduce trade risk on the way to projected goals. Moreover, after a GorillaPick confirms, the recommended stop level is raised to further reduce any unnecessary trade risk.

To put it very simply, some subscribers enter at the Trigger Price (high risk, but potentially higher returns), while others enter upon confirmation (lower risk, but lower potential returns). More aggressive subscribers receive a jump-start. However, with every advantage, comes a disadvantage. The aggressive subscribers will also end up with the losers that never do go on to confirm. The Gorilla simply suggests that those subscribers who wish to increase their probability of success with any given Gorilla trade, give up the average of 2%-3%, by waiting for confirmation. The Gorilla leaves this choice to you. Either way, you end up a winner!

Confirmation Day

An event that occurs as a result of above average daily volume that fortifies a stock’s desired direction. Any point in time that a stock trades at, or through, its “trigger price,” with above average volume, and has been authorized for purchase under GorillaTrades rules.

A GorillaPick can trigger and confirm on the same day if the appropriate volume is present. The Confirmation Day is an event and not an exact price. Entry points after Confirmation are at the discretion of the subscriber. GorillaPicks that have a Confirmation Day are posted in the nightly email.

Please understand that “Confirmation” is an event, not a price, so the specifics of where you enter the trade after Confirmation Day are at your own discretion. There’s no rule that you must purchase immediately after a Confirmation Day is declared. The vast majority of GorillaPicks will in fact provide opportunities to enter on pullbacks, after “confirming”.

What exactly constitutes a Confirmation Day? To initially confirm, a triggered GorillaPick must do ALL of the following on the SAME day:

A GorillaPick must CLOSE higher than its previous close AND higher than where it opened.

A GorillaPick must CLOSE higher than its trigger price.

A GorillaPick must meet or exceed its specific volume level area.

Risk Rating Tool

A GorillaPick’s Risk Rating should always be taken into consideration, and understanding the Risk Rating is not difficult. The Gorilla is well aware of the fact that every investor wants the highest possible return. However, the oldest rule in investing is as follows; “the greater the risk, the higher the return.” A high Risk Rating usually defines a highly volatile stock. These stocks can produce volatile swings that are usually enough to shake most investors out of their position (whether they are long or short). Although a particular 5-rated GorillaPick, the most risk on a 1-5 scale, appears very strong, its high Risk Rating alerts subscribers to the fact that it has a greater potential of producing a considerably larger loss. Since these stocks have larger targets, they will generally have “looser” stops.

A higher Risk Rating figure may provide more volatile price action, which could result in larger targets OR losses. GorillaPicks with lower Risk Ratings usually take longer to achieve their projected goals, but provide the least amount of potential trade risk.

Banana Barometer

A feature of the Subscriber’s GorillaTrades.com website that gives a broad overview of the market environment. The Banana Barometer lists near-term support and resistance levels for the three major indices.

Light Volume Pullback (LVPB)

The LVPB list is used to alert subscribers of GorillaPicks in the current portfolio that have achieved their first target, but are now experiencing a non-damaging decline in price. This is an opportunity for subscribers to potentially jump back into strong continuation patterns that may have a high probability of future advancement.

Many of these GorillaPicks are chosen immediately after a clear, short-term trend reversal has occurred. These stocks are exhibiting strength, regardless of the overall market environment. This area may provide the opportunity for a high probability entry. Whether using this tool to initiate new purchases or add to existing positions, the Gorilla recommends concentrating on second target goals, while always carrying an exit strategy based upon your personal risk tolerance.

At times, like during steep market sell-offs or a very strong portfolio, there will be an abnormally large number of Light-Volume Pullbacks (LVPBs). At other times (when the overall market becomes over-extended), there may be no LVPBs. This feature assists GorillaTrades subscribers in making wise investment decisions; those with the greatest probability of success.

Return to Risk Ratio (RTR tool)

The RTR tool enables subscribers to quickly sift through the current portfolio to identify those GorillaPicks that are exhibiting strength greater than the market itself or are experiencing a non-threatening pullback. A larger RTR number indicates that a GorillaPick is closer to its stop-loss level than its second target. It can also detect GorillaPicks that are experiencing a mild pullback. A smaller number indicates that a GorillaPick is closer to its second target than it is to its stop-loss level. These GorillaPicks are exhibiting strength versus the overall market.

The higher the number, the greater the risk that a GorillaPick may stop out, but the losses incurred will be small in relation to the potential rewards.

The smaller the number, the less risk there is that a GorillaPick will stop out. The losses incurred may be larger in relation to the potential rewards.

Special Situations Radar Screen

These picks are among the scarcest picks. The picks that appear on this special radar screen are meant to be a “bonus” to the GorillaTrades service. Unlike GorillaPicks, you are on your own with these picks and do not receive ANY guidance. Additionally, the market cap of these stocks can sometimes be VERY low and they can be quite volatile. Only more aggressive subscribers should consider these picks. These picks are meant to have longer holding periods (several months in most cases). The charts of these stocks will not always follow the text book definition of a true GorillaPick, but are considered for their extreme return potential. The charts of these stocks frequently resemble “early-stage,” or premature, cup-and-handle patterns. Please always carry an exit strategy with each trade, and never invest more than 10% of your capital in any ONE position!