GorillaPick Tutorial

Take this quiz to see how well you understand the GorillaTrades system.

This is a 22-question, multiple-choice quiz that takes less than 10 minutes to complete.

Results

Congratulations! You passed the quiz. If you email us your score, we will extend your free trial or current subscription by 15 days. Click here to email your score now.

Unfortunately, you didn’t do very well. Please review the System Tutorial, and if you can score an 18 or higher, we will reward you with a prize for your effort. Good luck!

#1. For a new, potential GorillaPick to be entered in the GorillaTrades portfolio, the stock must:

#2. When a stock gaps higher (above it’s trigger price), after initially being listed as a new potential “GorillaPick”, the printed Trigger Price becomes:

#3. When a new, potential GorillaPick initially gaps higher (above it’s trigger price) by more than __________________, it is not considered for purchase.

#4. When a GorillaPick achieves it’s first target a portion is recommended for sale for:

Partially correct. The answer is “All of the above”.

#5. When purchasing stocks, the upside potential is theoretically:

#6. When shorting stocks, the risk associated with the trade is:

#7. Second target goals are regularly _______ on a weekly basis (every Monday evening), as GorillaPicks show strength against the overall market.

#8. When entering any new trade, a __________ is used to reduce risk, while preserving capital.

#9. When entering any new trades, a/an ________ should be assigned to each and every trade to reduce risk.

#10. What key factor determines when a GorillaPick experiences a Confirmation Day?

#11. A GorillaPick can “trigger” and “confirm” in the same trading session.

#12. Waiting for a GorillaPick to “confirm”, drastically increases the ________ of success with the trade.

#13. The Confirmation Day is a/an __________, and not an exact __________.

#14. A general rule when investing in the marketplace is:

#15. A tool found at the GorillaTrades subscriber’s site that is used to communicate the current market environment, with specific support and resistance levels of the major indices is the:

#16. The _________ list is used to alert subscribers of GorillaPicks in the current portfolio that have achieved their first target and are currently experiencing a non-damaging decline in price. This allows subscribers to potentially “jump” back into strong continuation patterns which may have a high probability of future advancement.

#17. When reviewing RTR ratings, the higher the rating, the greater the risk that a GorillaPick may stop out, but the potential rewards are much greater than the potential loss.

#18. A major ingredient in the Risk Rating calculation:

#19. When reviewing the RTR rating, the lower the rating, the smaller the potential return, but less risk it will stop out:

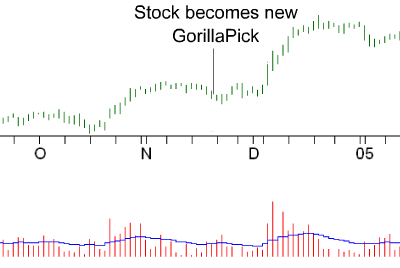

#20. On which day does this potential GorillaPick initially trigger and officially enter the GorillaTrades portfolio?

The 4th day is the first time that the stock trades above the trigger price (high of the session before the stock was declared a GorillaPick).

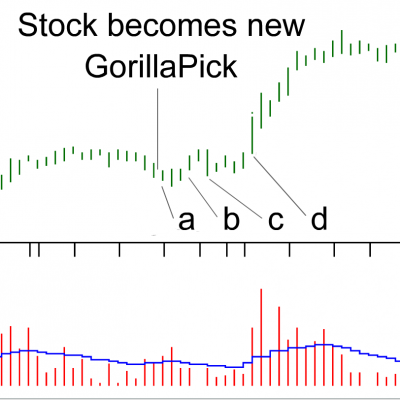

#21. At what point does this GorillaPick actually CONFIRM?

Point D is the first time that the stock both trades above the trigger price and has above average volume.

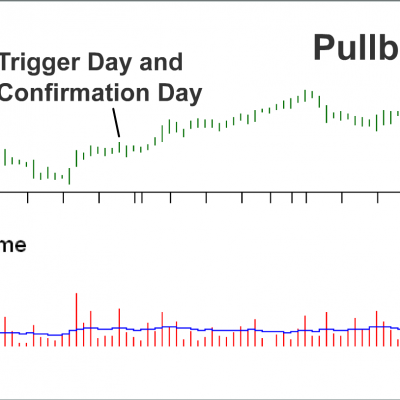

#22. The pictured pullback is likely to be non-damaging.

Incorrect. The stock’s decline in price has a corresponding decline in volume, the main indicator of a non-damaging pullback.